It’s no secret that the NBA’s ratings are declining. The rate of decline in 2020 has increased at an alarming rate, as the NBA Finals averaged 7.5 million viewers per game, a 48% drop from the 2019 Finals. According to the Associated Press, the loss was caused by a variety of factors:

“Revenue projections for the league this season were missed by about 1.5 billion dollars,” the person said. “The losses were the result of a combination of factors — the shutdown caused by the pandemic, the cancellation of 171 regular-season games, completing the season in a bubble at Walt Disney World without fans, the nearly $200 million price tag for operating that bubble and a yearlong rift with the Chinese government that saw NBA games not shown on state television there.”

Yet, despite all this, it is still regarded as one of the biggest and most valuable associations in all of the world’s sports.

Because it is not a public entity, the NBA decided not to release detailed financial reports to the public. However, Forbes, which regularly evaluates all 30 NBA teams, revealed that in the 2019/20 season, the total income of NBA teams was approximately 7.92 billion dollars, and the average income of each team was 263.87 million dollars on the season.

With a 24 billion dollars television broadcast deal, a billion-dollar Nike deal, a growing number of corporate sponsors, rapid international growth, ticket sales, and an NBA team value of more than a billion dollars on average, the NBA has been an innovative source of income in sports and entertainment. This has brought in investments from a variety of passionate or profit-oriented individuals, the most famous of which are technology billionaires, successful female executives, real estate moguls, and other successful business professionals.

BACKGROUND OF THE NBA

The National Basketball Association (NBA) is a professional basketball league formed in 1949 by the merger of two opposing organizations, the National Basketball League (founded in 1937) and the American Basketball Association (founded in 1946). In 1976, the NBA absorbed four teams from the American Basketball Association (ABA), which was disbanded that year.

In the early 1980s, the NBA was plagued by franchise losses, low attendance, declining television ratings, and limited national appeal. Under the leadership of David Stern, the president of the NBA since 1984, the league quickly regained its vitality and was transformed into an international entertainment company. This was achieved through innovation, including league player salary caps, profitable broadcast rights for cable and Internet TV, and the expansion of celebrations for the All-Star Game.

By actively and intelligently marketing famous star players (such as Magic Johnson, Larry Bird, and especially Michael Jordan), they attracted the global market and accelerated the international visibility of the league. Therefore, the NBA broadcasts to all countries.

HOW DO THE NBA MAKE MONEY?

Most of the revenue generated by the NBA and its subsidiaries is classified as Basketball Related Revenue (BRI). This includes ticket purchases and discounts, TV deals to deliver games to viewers’ homes, and merchandising rights for apparel and jersey sales. What is not included in the BRI is the income used to expand the team, the fines imposed during the season, and the distribution of income.

NBA’s Television Revenue

In the past 15 years, TV ratings have declined due to various technological advancements, including streaming services and DVR. However, live sports are still largely unaffected by this trend. As a result, the network paid high fees for broadcasting these games.

In February 2016, the NBA announced a nine-year media copyright agreement with ESPN and Turner Sports worth 24 billion dollars. When the deal took effect in the 2016/17 season, ESPN and Turner Sports agreed to pay a total of 2.6 billion dollars to the NBA each year.

The last deal signed in 2007 cost the two networks 930 million dollars per year. The new media copyright agreement is a 180% increase over the previous agreement.

NBA’s Merchandising Revenue

The annual value of the NBA merchandise exceeds a billion dollars. In the 2017/18 season, for the first time in NBA history, teams wore advertisements on their jerseys.

Jersey patch — launched in 2016 — revenue alone, on average, earns the teams 9.3 million dollars per year. Initial success led the NBA to extend the program in early 2019. So far, the NBA revenue has exceeded 150 million dollars.

Some advertisers include General Electric, the Walt Disney Company, and the Japanese e-commerce company Rakuten. The team also benefits from it; for example, the annual revenue of the Rakuten Golden State Warriors is estimated at 20 million dollars.

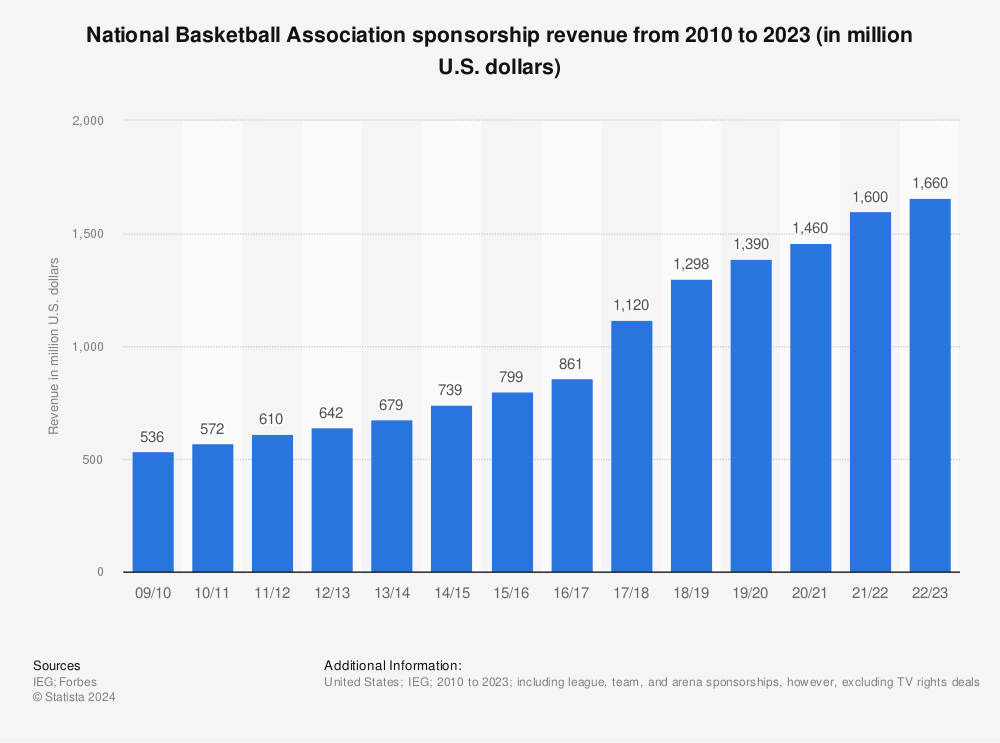

NBA’s Sponsorship Deals

In 2015, the NBA office ended its long-term partnership with Adidas and signed an eight-year, million-dollar contract with Nike. This is an increase of 245% compared to previous deals.

Another example of sponsorship is the Milwaukee Bucks, which opened a $524 million stadium in 2018. Since then, numerous sponsorship opportunities and opportunities for high-quality seats have appeared.

In the 2018/19 season, the league and its teams generated nearly 1.3 billion dollars in sponsorship revenue.

NBA’s Ticketing Business

Ticket sales are the main source of revenue for the NBA, and although they cannot be compared with other sources of revenue, they still play a vital role in the grand plan.

According to ESPN data, in the 2018-2019 season, the team averaged less than 15,000 to more than 20,000 fans in each home game. As the average ticket price is close to 74 dollars (in the 2018-19 season), ticket sales revenue has increased rapidly. In addition to tickets, the additional Basketball-Related Revenue (BRI) also includes discounts and other sales.

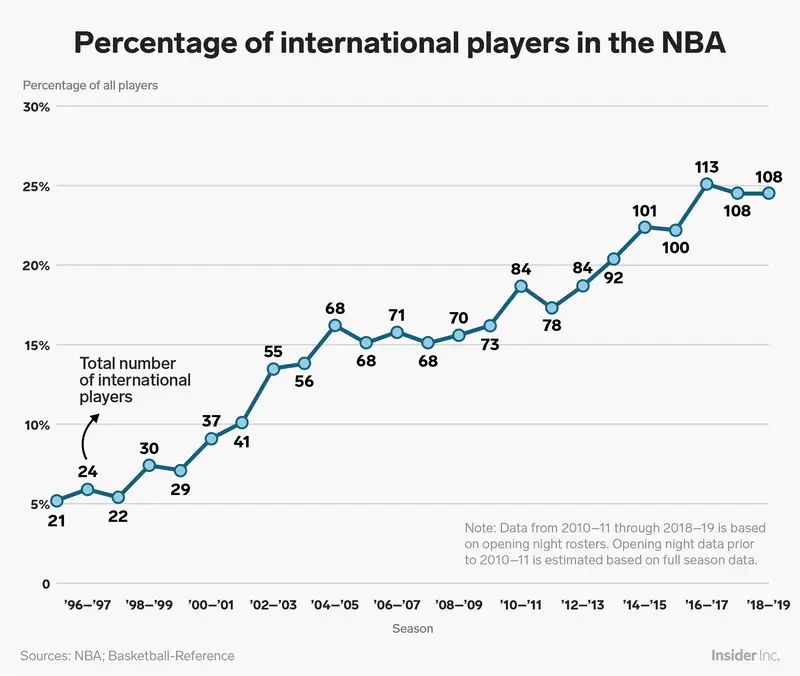

NBA’s International Revenue

The NBA has expanded internationally for many years and has become a major source of income, especially in China. China is estimated to generate 500 million dollars in revenue each year. Part of the proceeds includes a deal for Chinese tech giant Tencent to become the NBA’s exclusive digital partner for 1.5 billion dollars.

International investors also have greater international appeal. For example, Alibaba (BABA) Joe Tsai bought a 49% stake in the Brooklyn Nets last year for a rumored 1.15 billion dollars.

The international revenue stream is also related to the NBA’s decision to relax marketing rules for placing advertising logos on jerseys. As a result, many international companies can now advertise in the NBA through the jersey patch program and other marketing initiatives. Expansion in China and around the world is of strategic significance and may generate an increasing share of the NBA’s overall revenue in the next few years.

HOW MUCH DO NBA OWNERS MAKE?

Daniel Gilbert

Cleveland Cavaliers owner Daniel Gilbert is the youngest NBA team owner. Most of his net worth of 7.4 billion dollars comes from real estate. He is the co-founder of Quicken Loans, the largest mortgage lender in the United States. The organization was co-founded in 1985. It was sold for 632 million dollars in 1999 and repurchased for 64 million dollars a few years later.

Even though LeBron James left the team, the Cavaliers are still worth more than one billion dollars. Despite feeling the on-court effect of LeBron’s exit, the team was still able to achieve high ticket sales.

375 million dollars was paid for the Cleveland Cavaliers in 2005. Operating income was 302 million US dollars, entry income was 152 million US dollars, and it had a wins-to-player cost ratio of 128 dollars. The team’s revenue per player was 93 dollars.

Gilbert makes $500 million after the most recent team valuation.

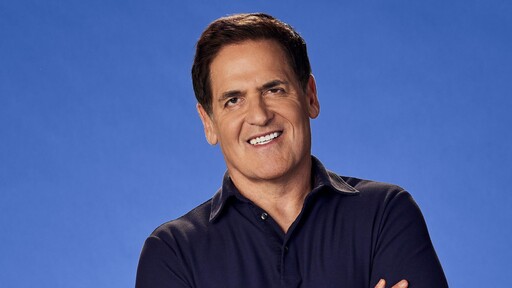

Mark Cuban

Mark Cuban’s Mavericks have a loyal fan base who have made great contributions to the Mavericks’ rise in the league. Fan loyalty is due in large part to billionaire Mark Cuban’s deep knowledge of sports and entertainment and his ambition to meet the needs of Mavericks fans.

Cuban bought a majority stake in the Mavericks for 280 million dollars in 2000. He said he never thought the deal was an investment. He did it because he loves basketball. After the acquisition was completed, the team was strengthened with new members, which helped the team win the league championship in 2011.

The brand has accumulated a fortune of 3.9 billion dollars from the technology industry. After selling the online streaming company Broadcast.com to Yahoo, he became a billionaire.

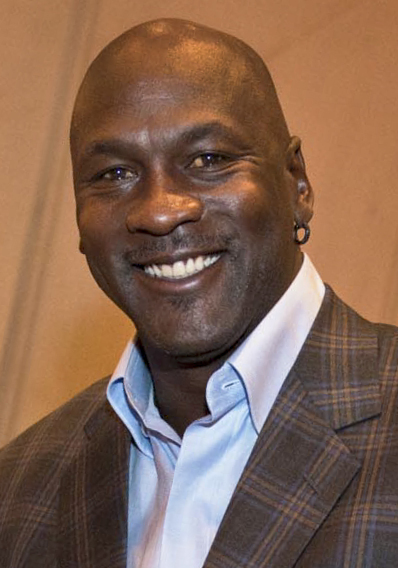

Michael Jordan

Michael Jordan’s time playing in the NBA is a thing of legend. He is the greatest player in NBA history, winning six championships and five MVP awards. His success put him on the Forbes list with a net worth of 1.9 billion dollars, and as a team owner, Jordan has always made a deep impression. He spent 180 million dollars to get a majority stake in an NBA team.

In 2014, the team was rebranded to the Hornets. Now, it is worth more than 1.3 billion dollars and is the 28th most valuable team in the league. Since Jordan acquired the Hornets, the team’s value has increased by 757%, making its investment 4.7 times better than that of the S&P 500.

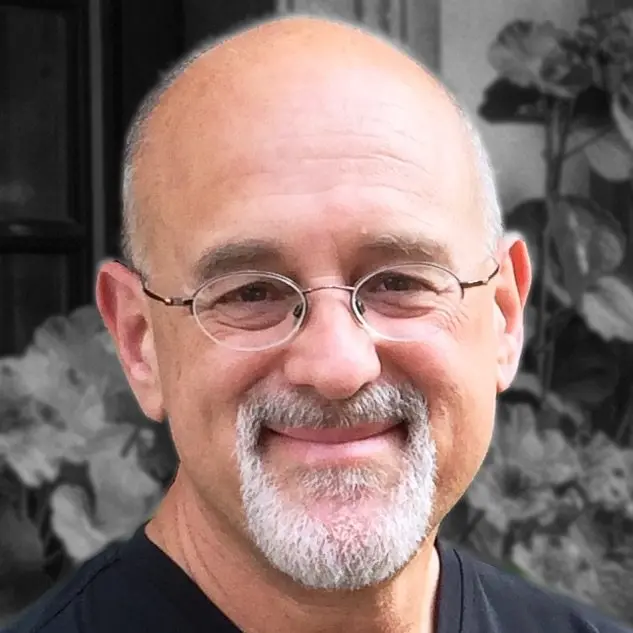

Michael Rubin

Rubin started his career by owning his ski shop in Pennsylvania when he was a teenager. According to people, he used the money gotten from his bar mitzvah. After establishing his skiing empire, he founded another sports company, the sports equipment brand KPR Sports. He also founded an e-commerce company, GSI Commerce, which he sold to eBay in 2011 for 2.4 billion dollars.

The place expenses of the 76ers are $105 million. The income of each team fan is 25 dollars and while it is relatively low, it has been able to earn substantial revenue, 268 million dollars, and 68 million dollars in operating income. Attendance at the game has always been high. The team’s valuation rose to 1.65 billion dollars, providing investors with a substantial return.

Richard DeVos

Amway founder Richard DeVos bought the Orlando Magic in 1991 for 85 million dollars. Its investment profit was 1.1 billion dollars. DeVos’ company, Amway, was founded in 1959 by a friend from high school. In 2017 alone, its revenue exceeded 8.5 billion dollars.

Orland’s player fees are 108 million dollars. The team’s gate revenue is 35 million dollars. After generating 223 million dollars in revenue, it is valued at 1.3 billion dollars. The club’s income per fan is 40 dollars.

Steve Ballmer

Steve Ballmer seems to have the same enthusiasm for the Los Angeles Clippers as he does as the CEO of Microsoft. Since acquiring the Los Angeles Clippers for a staggering 2 billion dollars, he has worked tirelessly to make this team a world-class basketball team. As the valuation of more and more teams rose, Ballmer’s acquisition of the Clippers caused ripples in the league.

If he can successfully improve the status of the Los Angeles Clippers in the league, Ballmer can add substantial numbers to his net worth of $37.1 billion, most of which comes from Microsoft. In the 1980s, he dropped out of Stanford University to join Microsoft and became its 30th employee.

The Clippers announced revenue of 258 million dollars, with the fan’s revenue being 23 dollars. The team’s wins-to-player cost ratio of 82. It made an operating income of 40 million dollars. The team’s ticket revenue exceeded 52 million dollars.